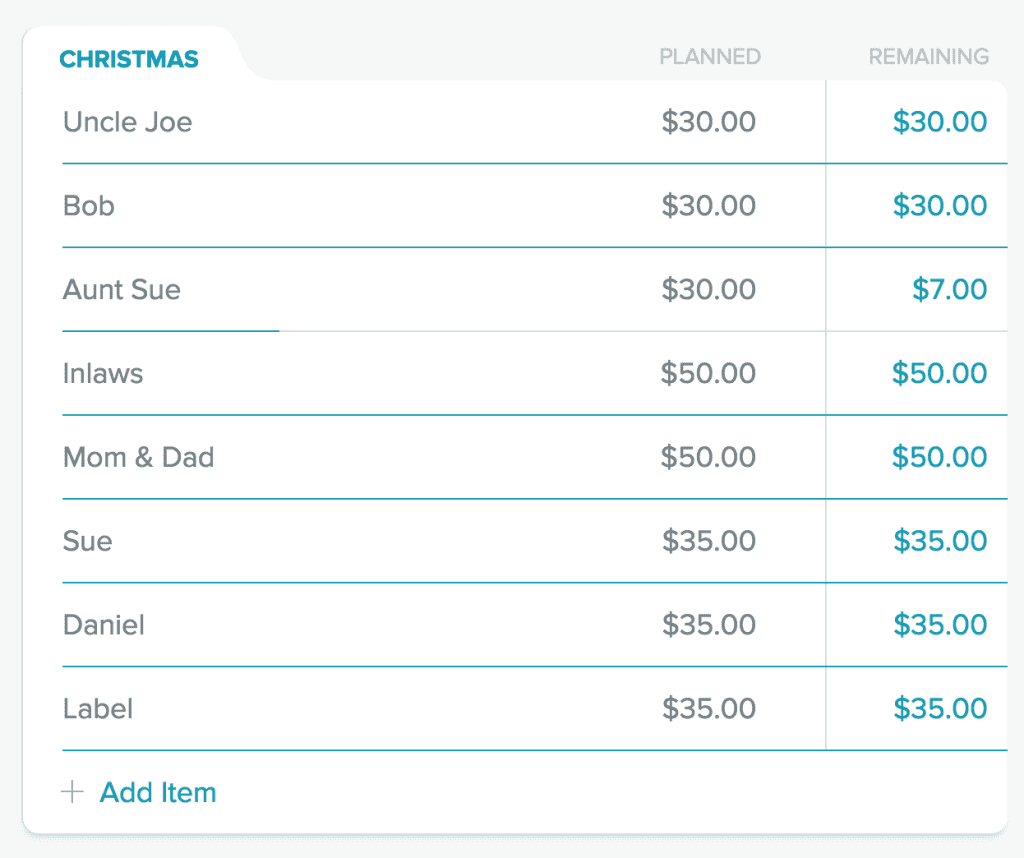

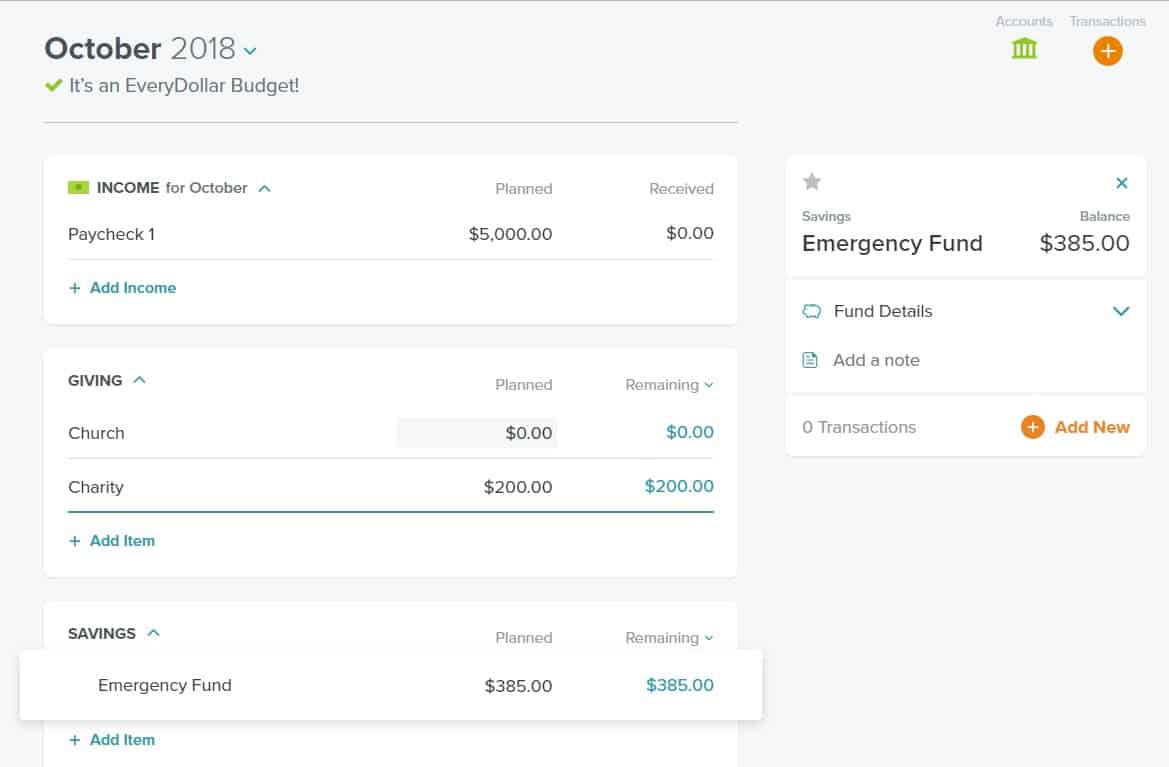

Once setup it really takes no work at all to have a ton of slush funds, all balanced, and using EveryDollars ability to show balance and not sync transactions you can spot balances that are too rich or too low easily!Įdit: totally didn’t realized I never answered your basic question 🙄!!! ) or doing a virtual account like some budget apps.) Sometimes we just don’t spend everything for food or something and I don’t realize I didn’t move the money from one account or another and I have a nice “found money” situation ) In my case I could have $6-7k sitting in savings accounts for home taxes/home insurance/car repair fund etc and I don’t want to accidentally see that I have 6k available to spend since I don’t I may only have $200 left in budget. Then when my wife or I buy something, I transfer exactly that much money from the Christmas account to checking and then drag that transaction in EveryDollar to Christmas and then the budget is green and not overspent.Īs I said it is a PITA to setup with all the accounts but I like it so much more than a general slush fund, or using EveryDollars built in slush fund (which I personally think is terrible since it shows you have remaining money in the overall budget for the month but you really don’t. I drag the transfer transaction in EveryDollar to CHRISTMAS and it is perfectly spent and green So in EveryDollar I have a line item that shows I have planned spending of $150 for Christmas. I save $150/mo for Christmas presents for all the family.

I do the same thing with Christmas fund and all the others. Since I turn off syncing transactions from the savings and I do sync from my checking, it shows a +$75 transaction and I drag and drop that onto the bug fund line item in EveryDollar which makes the EveryDollar balance back out to exactly $0 and is green. Then I make a transfer from my BUG fund account to my Checking account for $75. Then, like this month, when the bug company charges me $75 on my credit card, I drag that $-75 transaction to my bug fund which makes that account look like it is overspent by $75 and it shows as red

So EveryDollar syncs my transactions from my checking which will show a $-39 transaction from my checking and I drag and drop that transaction onto a separate line item in EveryDollar Each savings account has a purpose and a name and i automatically transfer money from my checking account to my savings account the $39/mo to “save” for the bills when they come due. So I have a checking account at my bank that I do sync transactions from and around 25 separate savings accounts. The bills for normal pest control is $25/mo paid quarterly and like $170 year for termite control ($14/mo) I’ll use the bug fund of mine to demonstrate!Įvery month I slush fund $39/mo to cover pest control and termite reinspection. This method would suck without paying the $10/mo however so premium is a must but pretty cool if you dig the podcast anyway to show support for decent products So EveryDollar is pretty much the only thing, not to say it is bad, but $10/mo is pretty steep! I love zero dollar budgeting and absolutely dislike YNAB 😂 Yeah it is pretty wonky but I have to say this

0 kommentar(er)

0 kommentar(er)